An audit manager job description outlines the duties, responsibilities, and qualifications required for an audit manager position within an organization. It serves as a guide for hiring managers and candidates alike, ensuring a clear understanding of the role’s expectations and requirements.

Audit managers play a crucial role in ensuring the accuracy and integrity of financial reporting. They lead and supervise audit teams, manage risk assessments, and communicate audit findings to senior management and external stakeholders. Their expertise in accounting principles, auditing standards, and risk management makes them essential for maintaining the financial health and reputation of an organization.

The main article topics will delve deeper into the specific duties and responsibilities of an audit manager, the qualifications and experience required for the role, and the career path and earning potential associated with this position.

1. Leadership

This aspect of the audit manager job description highlights the leadership responsibilities of the role. Audit managers are expected to lead and supervise audit teams, providing guidance and support to team members. This involves setting clear expectations, delegating tasks effectively, and providing ongoing feedback and support.

-

Facet 1: Team Management

Audit managers are responsible for building and managing effective audit teams. This includes recruiting, training, and developing team members, as well as assigning tasks and monitoring progress.

-

Facet 2: Communication and Collaboration

Audit managers must be able to communicate effectively with team members, other departments, and external stakeholders. They need to be able to clearly articulate audit findings and recommendations, and collaborate with others to develop and implement solutions.

-

Facet 3: Problem-Solving and Decision-Making

Audit managers are often faced with complex problems and must be able to make sound decisions in a timely manner. They need to be able to analyze information, identify risks, and develop appropriate audit plans.

-

Facet 4: Continuous Improvement

Audit managers are responsible for continuously improving the audit process. This includes identifying areas for improvement and developing new strategies and techniques.

These facets of leadership are essential for the success of audit managers. By effectively leading and supervising audit teams, audit managers can ensure that audits are conducted efficiently and effectively, and that audit findings are communicated clearly and acted upon.

2. Risk Assessment

Risk assessment is a critical component of the audit manager job description. Audit managers are responsible for identifying and assessing risks that could impact an organization’s financial and operational performance. They then develop and implement audit plans to mitigate these risks.

-

Facet 1: Risk Identification

Audit managers use a variety of techniques to identify risks, including reviewing financial statements, interviewing management and staff, and conducting site visits. They consider both internal and external risks, as well as potential fraud risks.

-

Facet 2: Risk Assessment

Once risks have been identified, audit managers assess the likelihood and potential impact of each risk. They consider the organization’s risk tolerance and develop mitigation strategies accordingly.

-

Facet 3: Audit Planning

Audit managers develop audit plans that are designed to address the identified risks. These plans include the scope of the audit, the audit procedures to be performed, and the reporting requirements.

-

Facet 4: Risk Monitoring

Audit managers monitor risks on an ongoing basis and make adjustments to audit plans as needed. They also communicate risks to senior management and the audit committee.

These four facets of risk assessment are essential for the success of audit managers. By effectively identifying, assessing, and mitigating risks, audit managers can help organizations to avoid financial and operational losses.

3. Communication

Effective communication is essential for audit managers. They need to be able to clearly and concisely communicate audit findings and recommendations to a variety of audiences, including senior management, external stakeholders, and regulatory bodies.

-

Internal Communication

Audit managers communicate audit findings and recommendations to senior management on a regular basis. This communication may be in the form of written reports, presentations, or informal discussions. Audit managers need to be able to clearly and concisely communicate complex technical information to non-auditors.

-

External Communication

Audit managers also communicate audit findings and recommendations to external stakeholders, such as investors, creditors, and customers. This communication may be in the form of financial statements, audit reports, or other public disclosures. Audit managers need to be able to communicate audit findings and recommendations in a way that is both accurate and understandable to non-auditors.

-

Regulatory Communication

Audit managers also communicate audit findings and recommendations to regulatory bodies, such as the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB). This communication may be in the form of audit reports, deficiency letters, or other correspondence. Audit managers need to be able to communicate audit findings and recommendations in a way that is both accurate and compliant with regulatory requirements.

The ability to communicate effectively is essential for audit managers. By effectively communicating audit findings and recommendations, audit managers can help organizations to improve their financial reporting, internal controls, and risk management practices.

4. Expertise

Expertise in accounting principles, auditing standards, and risk management is essential for audit managers. This expertise enables them to effectively lead and supervise audit teams, assess risks, and communicate audit findings and recommendations. Without this expertise, audit managers would not be able to perform their jobs effectively and ensure the accuracy and integrity of financial reporting.

-

Facet 1: Accounting Principles

Audit managers must have a thorough understanding of accounting principles, including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). This knowledge enables them to assess whether financial statements are prepared in accordance with applicable accounting standards and to identify potential accounting errors or misstatements.

-

Facet 2: Auditing Standards

Audit managers must also be familiar with auditing standards, such as the International Standards on Auditing (ISA) and the Generally Accepted Auditing Standards (GAAS). This knowledge enables them to plan and perform audits in accordance with professional standards and to ensure that audit reports are accurate and reliable.

-

Facet 3: Risk Management

Audit managers must have a solid understanding of risk management principles and techniques. This knowledge enables them to identify and assess risks that could impact an organization’s financial and operational performance. Audit managers use this knowledge to develop and implement audit plans that are designed to mitigate these risks.

In summary, the expertise that audit managers possess in accounting principles, auditing standards, and risk management is essential for the effective performance of their duties and responsibilities. This expertise enables them to ensure the accuracy and integrity of financial reporting and to help organizations to improve their financial performance and risk management practices.

Frequently Asked Questions about Audit Manager Job Descriptions

This section provides answers to some of the most frequently asked questions about audit manager job descriptions.

Question 1: What are the primary responsibilities of an audit manager?

Audit managers are responsible for leading and supervising audit teams, assessing risks, and communicating audit findings and recommendations. They play a critical role in ensuring the accuracy and integrity of financial reporting.

Question 2: What qualifications are typically required for an audit manager position?

Audit managers typically need a bachelor’s degree in accounting or a related field, as well as several years of experience in auditing. They must also have a strong understanding of accounting principles, auditing standards, and risk management.

Question 3: What are the career prospects for audit managers?

Audit managers can advance to senior management positions, such as audit director or chief audit executive. They may also move into other areas of finance, such as financial management or consulting.

Question 4: What is the average salary for an audit manager?

The average salary for an audit manager varies depending on factors such as experience, location, and company size. However, according to the Robert Half Salary Guide, the average salary for an audit manager in the United States is $111,500.

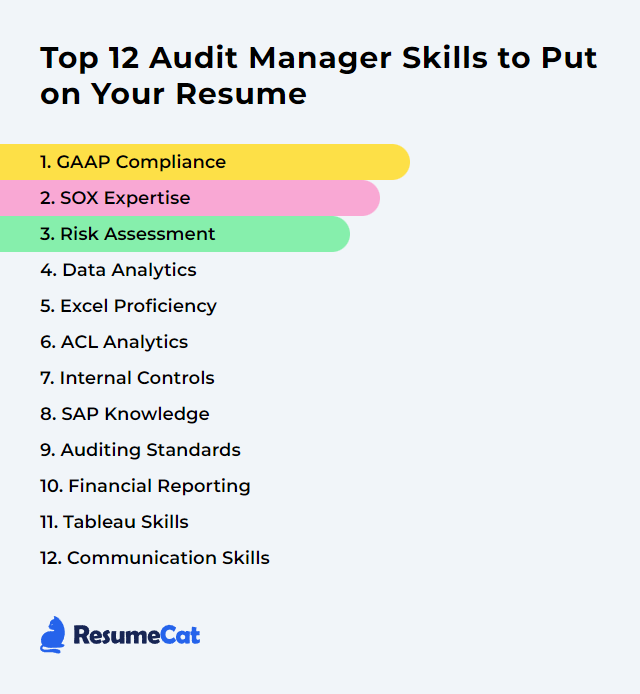

Question 5: What are the key skills and competencies required for an audit manager?

Audit managers need strong technical skills in accounting and auditing, as well as leadership, communication, and problem-solving skills. They must also be able to work independently and as part of a team.

Question 6: What is the job outlook for audit managers?

The job outlook for audit managers is expected to be positive in the coming years. The increasing complexity of financial reporting and the growing emphasis on risk management are driving demand for qualified audit managers.

These are just a few of the most frequently asked questions about audit manager job descriptions. For more information, please consult the resources listed below.

Transition to the next article section: Audit Manager Responsibilities

Audit Manager Job Description Tips

To ensure the effectiveness of an audit manager job description, consider the following tips:

Tip 1: Clearly define the role and responsibilities.

The job description should clearly outline the audit manager’s duties and responsibilities, including leading and supervising audit teams, assessing risks, and communicating audit findings and recommendations.

Tip 2: Specify the required qualifications and experience.

The job description should specify the minimum qualifications and experience required for the role, such as a bachelor’s degree in accounting or a related field, as well as several years of experience in auditing.

Tip 3: Include key skills and competencies.

The job description should list the key skills and competencies required for the role, such as strong technical skills in accounting and auditing, as well as leadership, communication, and problem-solving skills.

Tip 4: Describe the career path and earning potential.

The job description may include information about the career path and earning potential for audit managers, such as the opportunity for advancement to senior management positions and the average salary range.

Tip 5: Use clear and concise language.

The job description should be written in clear and concise language that is easy to understand. Avoid using jargon or technical terms that may be unfamiliar to candidates.

Tip 6: Proofread carefully.

Before posting the job description, proofread it carefully for any errors in grammar, spelling, or punctuation.

Tip 7: Seek input from others.

Consider seeking input from other stakeholders, such as the hiring manager or human resources department, to ensure that the job description is accurate and effective.

Tip 8: Post the job description in multiple locations.

To attract a wider pool of candidates, post the job description in multiple locations, such as on the company website, job boards, and social media.

By following these tips, you can create an audit manager job description that is effective in attracting and hiring qualified candidates.

Summary of key takeaways or benefits:

- A well-written job description can help to attract and hire qualified candidates.

- A clear and concise job description can help candidates to understand the role and responsibilities of the audit manager position.

- By following the tips above, you can create an effective audit manager job description that will help you to find the best possible candidates for your organization.

Transition to the article’s conclusion:

By following these tips, you can create an audit manager job description that is effective in attracting and hiring qualified candidates. A well-written job description can help to ensure that your organization has the skilled professionals it needs to achieve its financial reporting and risk management objectives.